Airline programs call themselves “frequent flyer” or “loyalty” programs. At an earlier time, they were designed to induce and reward customers for choosing to fly on their product. With changes to the way airlines credit miles for flying—from distance to fare-based accrual—flying has become one of the least rewarding ways to earn airline miles.

By way of example, my roundtrip Chicago to Phoenix flight on American Airlines for Cubs Spring Training this past March earned a total of 1337 miles (including bonus miles for having Gold status), while a recent roundtrip flight from Chicago to New York on American Airlines earned 1778 miles (also including bonus miles for having Gold status). At those accrual rates, it would take more than 18 round trips between Chicago and Phoenix on American Airline to earn enough miles to take the same round trip flight on award miles, assuming saver award space is available. No wonder many people think miles and points are a waste of time!

Some of the more rewarding ways to earn airlines miles include:

–Credit Cards: new card sign-up bonuses, category bonuses and promotions, and everyday spending

–Online Shopping portals: everyday spending, seasonal and other promotions

–Dining Programs

–Investments

New card sign-up bonuses: Bonuses on new credit cards range between 10,000 and 100,000+. These can be in the form of airline miles, hotel points, convertible bank points (Chase has Ultimate Rewards points, American Express has Membership Rewards points, and Citibank has Thank You points) or cash back. Some hotel credit cards give free night certificates rather than hotel points, including some certificates that can be used at the highest hotel room category (e.g., I have two free night certificates on the old Citi Hilton HHonors Reserve card and am working on plans to use it at hotels that range between 80,000 points and 95,000 points per night, and I recently used two Hyatt award certificates to stay at a resort in Arizona called Miraval; a double occupancy award night at Miraval is ordinarily 70,000 Hyatt points per night).

Here’s a great post by my friend Harlan on what to do when you get a new credit card:

New Credit Card Checklist: What to Do When You Receive Your New Card

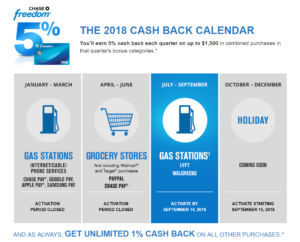

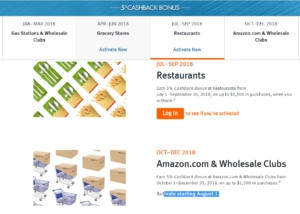

Category Bonuses: In addition, many credit cards offer bonus points in specific categories of spending. Popular categories for bonuses include: travel, dining, grocery stores, gas, office supplies, drug stores, and department stores. Some cards have the same bonus year-round, while others have rotating categories (such as the Chase Freedom and Discover It cards).

Discover It quarterly bonus categories:

Here’s a link to a post by Frequent Miler on the “best” card to use in each category of spending (and note the stickers on the front of the cards, which can be a helpful way to remember which card to use where):

Best Card for Grocery, Gas, Drugstores, Travel, Dining, More…

Promotional Bonuses: Some credit cards also occasionally offer targeted promotional spending bonuses. These are designed to get you to use the card, either for general purchases or in specific categories.

Citi recently sent me this offer for 5 bonus points: Use your card to earn 5 ThankYou Points per $1 spent, up to 2,500 points, through 08/31/2018 on eligible purchases you make at:

• Grocery Stores

• Gas Stations

• Drugstores

• Mass Transit & Commuter Transportation Vendors

And, Barclays has offered several variations of this offer the last few years:

Everyday Spending: Just about everything can be purchased with a credit card: dining out, groceries, and most retail purchases can generally be made on a credit card without any additional fee. With some effort, you can also pay your mortgage, property taxes, state and local taxes, student loans, utilities and even buy a car on your credit cards. Some places charge a processing fee to use a credit card, so you will want to find ways to reduce the processing cost and be certain you are getting more in value than you pay before using a vendor that requires paying to use a credit card. If you are just starting out, I recommend generally only using your cards at places where you can do so without incurring additional costs (though gas stations have been charging a higher rate for credit cards than for cash for a long time, and the relative convenience of paying at the pump can be worth the incremental difference in cost).

Be sure you can pay your bill in full each month before trying to earn points and miles on everything. No points and miles are worth the interest rates the banks charge, and no points and miles are worth the cost of harming your credit. Your most important asset is a good credit score!

Incredible blog, Angie. Very informative and well done! Thanks.

Thanks, Dan. It’s in the very early stages, but I hope to share what I’ve learned (and continue to learn) and hope it helps other earn and use more points and miles. Thanks for reading.

Wonderful info – even in Oregon where they pump your gas for you (state law) – don’t use cash!

So how do form/change “habits” around when to use the right card for the right situation so you don’t feel “Missing Miles” guilt – aka “Mental Hopscotch” – tx!